🍪 Daily Byte – 04.12.2025

By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- Bitcoin dancing around 94K

- XRP Price Prediction

- Connecticut halts crypto sports betting

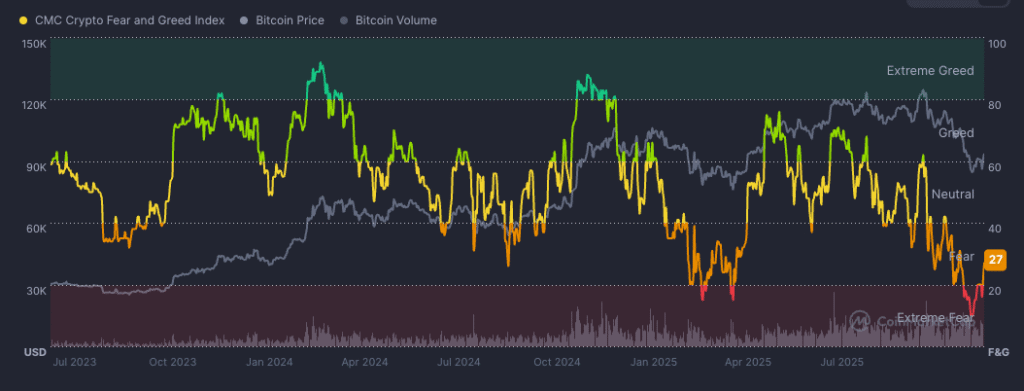

Fear & Greed Index Today

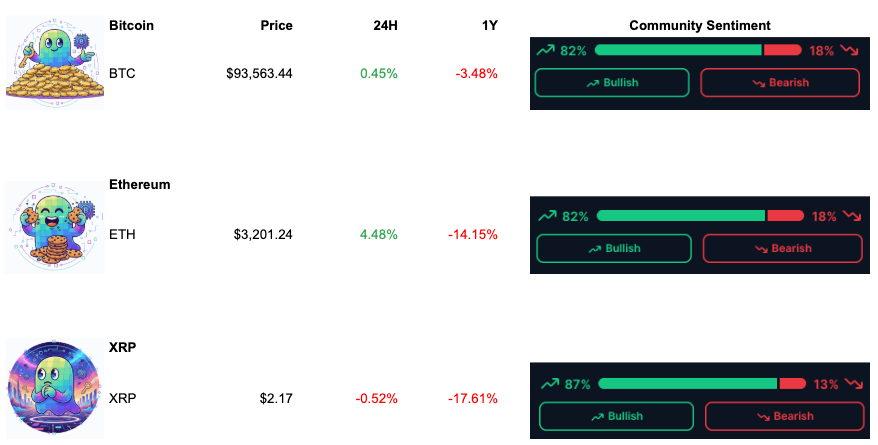

Prices as of 09:00 AM CET

₿ Bitcoin Dances Around $94K as Volatility Returns, Seller Exhaustion Builds & Structural Flows Shift

Bitcoin spent the last 24 hours grinding between $92,000 and $94,000, a tight range disguising a major shift happening under the surface.

On-chain metrics, derivatives positioning, and institutional flows now point to a market entering a macro transition phase, where fear is elevated but structural support is quietly strengthening.

A Volatile Push, but Not a Clean Trend (Yet)

After reclaiming $94K, BTC’s rebound lacks conviction — not surprising after days of whipsaw price action that shattered the short-term uptrend.

Bitcoin’s recent volatility spike is one of the sharpest since early summer, the exact type of turbulence that often precedes either:

- a retest lower, or

- the start of a slow grind toward a new trend

Ether, meanwhile, is flashing stronger momentum: derivatives positioning shows bullish skew returning, and open interest is climbing in a way that historically leads ETH to outperform BTC during recovery phases.

Relief Rally Incoming? Bitfinex Thinks So

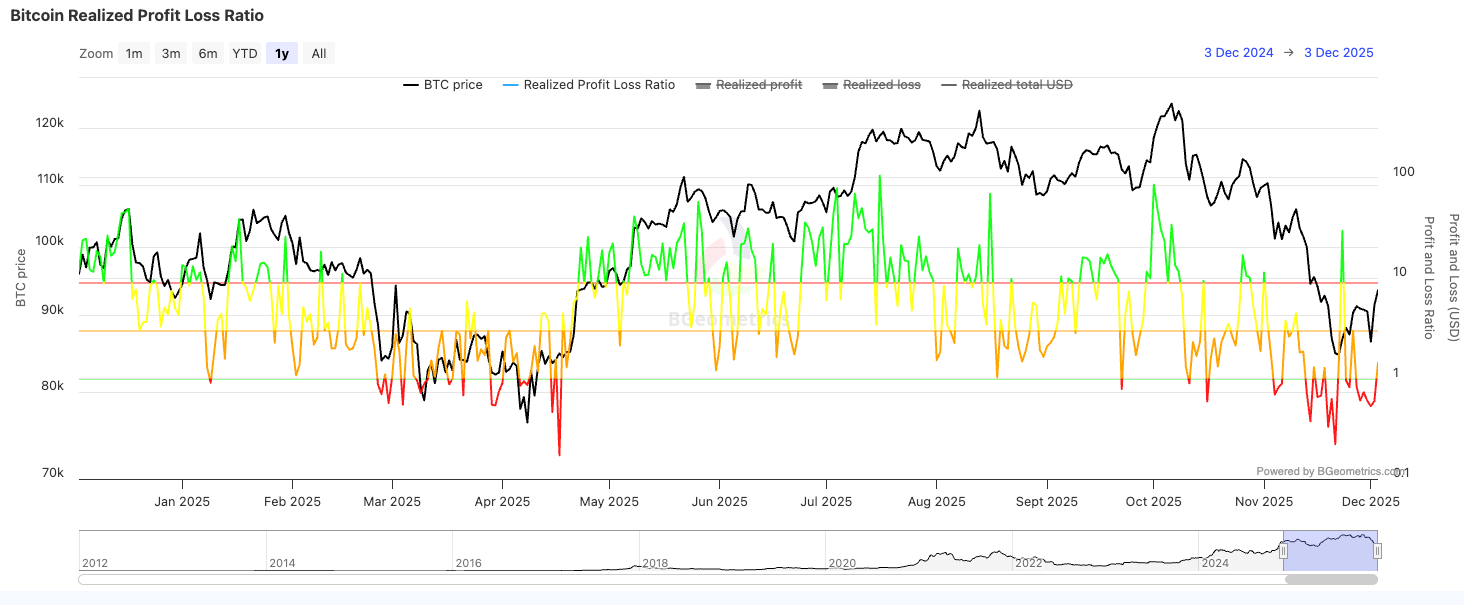

Bitfinex analysts flagged a clear signal: seller exhaustion is emerging.

Spent Output analytics show older coins are calming down, short-term holders are no longer panic-spending after each dip, and net realized losses are plateauing. The combination often precedes relief rallies, especially when liquidity stabilizes — which it is beginning to do.

The timing lines up with market structure as well.

Bitcoin is sitting directly above a high-value liquidity node, with heavy bid clusters between $89K–$92K absorbing every dip this week.

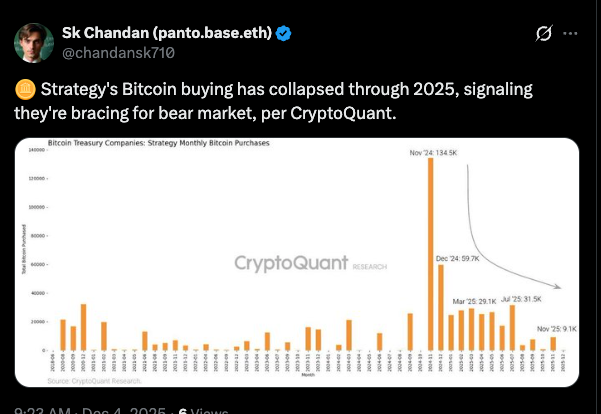

The Alarming Part: Strategy’s Buy Flows Are Shrinking

But there’s a darker undercurrent.

There is a sharp contraction in institutional buyer activity — specifically “Strategy’s” monthly accumulation. It dropped from 134,000 BTC at peak to just 9,100 BTC in November.

This doesn’t mean a bear market has arrived — it means big players are positioning for extended volatility, slower upside, and fewer forced inflows. Macro uncertainty is forcing them to conserve firepower.

So Where Does This Leave Bitcoin?

Right at the crossroads.

Bullish factors:

- Seller exhaustion

- Bid support under $92K

- ETH strength (historically good for broader risk recovery)

- Declining panic spending

- Liquidity stabilization

Bearish factors:

- Institutional accumulation collapsing

- Volatility breaking trend structure

- BTC still struggling to reclaim weekly momentum

Net effect?

Bitcoin is in a fragile-but-stabilizing phase, where a rebound toward $97K–$100K is possible — but without major inflows, the move may fade quickly.

For now, BTC is “dancing” around $94K — and the next macro cue will determine whether the music speeds up… or stops.

Institutions Rotate Into XRP Through ETFs, Analysts Warn a Violent Move 💰 Could Follow

XRP is back in the spotlight as institutional inflows surge through newly launched ETFs and structured macro trades.

Large players are quietly building exposure through products that allow regulated custody — a shift that often precedes sharp directional moves.

The setup is unusual: despite the broader market’s volatility, XRP has seen consistent net inflows, suggesting that allocators view current levels as discounted relative to long-term fundamentals.

A key driver is the expectation that liquidity conditions will improve once the Fed completes its policy pivot. As risk appetite returns, funds are positioning ahead of what they believe could be a high-beta catch-up phase for large caps that lagged BTC.

On-chain behavior mirrors this trend. Dormant supply has risen, short-term speculators have exited, and the token’s realized volatility is compressing — all hallmarks of a coiled asset.

Analysts warn that “violent moves” tend to erupt after periods of extreme compression.

ETF flow structure also matters. Because these products accumulate aggressively during low-volume periods, they naturally tighten order books and reduce circulating liquidity. If spot demand rises at the same time, price dislocations can become explosive.

For now, XRP remains bound in a multi-month range, but the accumulation footprint is growing clearer.

If flows continue at the current pace, traders may be staring at the early stages of a breakout setup that builds slowly… then detonates all at once.

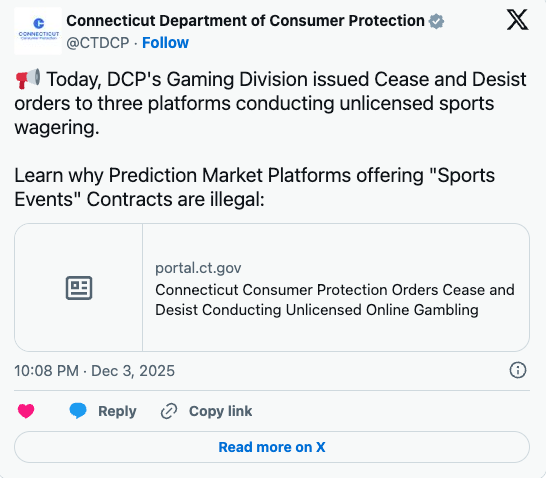

🇺🇸 Connecticut Orders Kalshi, Robinhood, and Crypto.com to Halt Sports Betting Activities

Connecticut regulators issued a sweeping cease-and-desist order targeting Kalshi, Robinhood, and Crypto.com, demanding that each platform immediately halt sports-related betting services offered to state residents.

The order reflects growing pushback from state-level regulators who argue that prediction markets and sports-related contracts fall under gambling laws, not commodities or derivatives frameworks.

Kalshi’s contracts — designed to let traders speculate on event outcomes — have long existed in a regulatory gray zone, and the state now claims the platform’s offerings constitute unlicensed gambling.

Robinhood and Crypto.com were included due to promotional campaigns and product pathways that allegedly facilitated access to such markets.

The enforcement move signals a broader trend:

States are increasingly asserting authority over crypto-adjacent financial products, especially those that resemble wagering. This comes amid a national debate between agencies over who has jurisdiction over prediction markets, event contracts, and tokenized betting platforms.

Connecticut’s order requires all three companies to provide documentation proving compliance, cease onboarding local users for affected products, and outline remedial plans.

Failure to comply could lead to fines, licensing restrictions, or full operational bans within the state.

The decision may ripple beyond Connecticut as other states evaluate how these markets intersect with existing gambling and consumer protection laws. The regulatory fog around event-based trading firms is thickening — and today’s ruling makes it clear that states intend to play a central role in shaping what comes next.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

If this helped you cut through the noise, join hundreds of readers who get Byte & Block in their inbox every morning

Subscribe to our newsletter!

Telegram Bot

Telegram Bot