News Byte – 09.02.2026

By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- Bitcoin Price Rebound Still Looks Fragile

- Bitcoin ETF Flows Improve, Conviction Lags

- Funding and OI Still Signal Chaos

Bitcoin Price Rebound Still Looks Fragile

Bitcoin bounced after flushing below $70K and reclaiming the mid-$60Ks, but this move still feels a bit suspicious. Not “new bull trend unlocked” suspicious — more like “everyone exhaled, then stared at the order book again” suspicious. The bounce was fast, emotional, and very headline-friendly, which is exactly when markets like to humble people.

What felt weird was the texture: sharp pushes, weak follow-through, then quick snapbacks. That usually screams positioning cleanup, not fresh conviction. If real spot demand is in control, price tends to grind and hold. If it’s mostly short-covering, you get fireworks first and doubt immediately after.

And that distinction matters, because squeeze rallies only become durable when buyers keep showing up after the excitement fades.

Without that follow-through, price usually revisits the same zone and smacks late longs. We saw the same script before: relief bounce first, conviction maybe later. So yes, reclaiming levels helps sentiment — but sentiment and structure are not the same thing.

What to watch next: does BTC hold reclaimed levels through US close and into Asia, or do we get another “nice bounce, shame if someone faded it” setup?

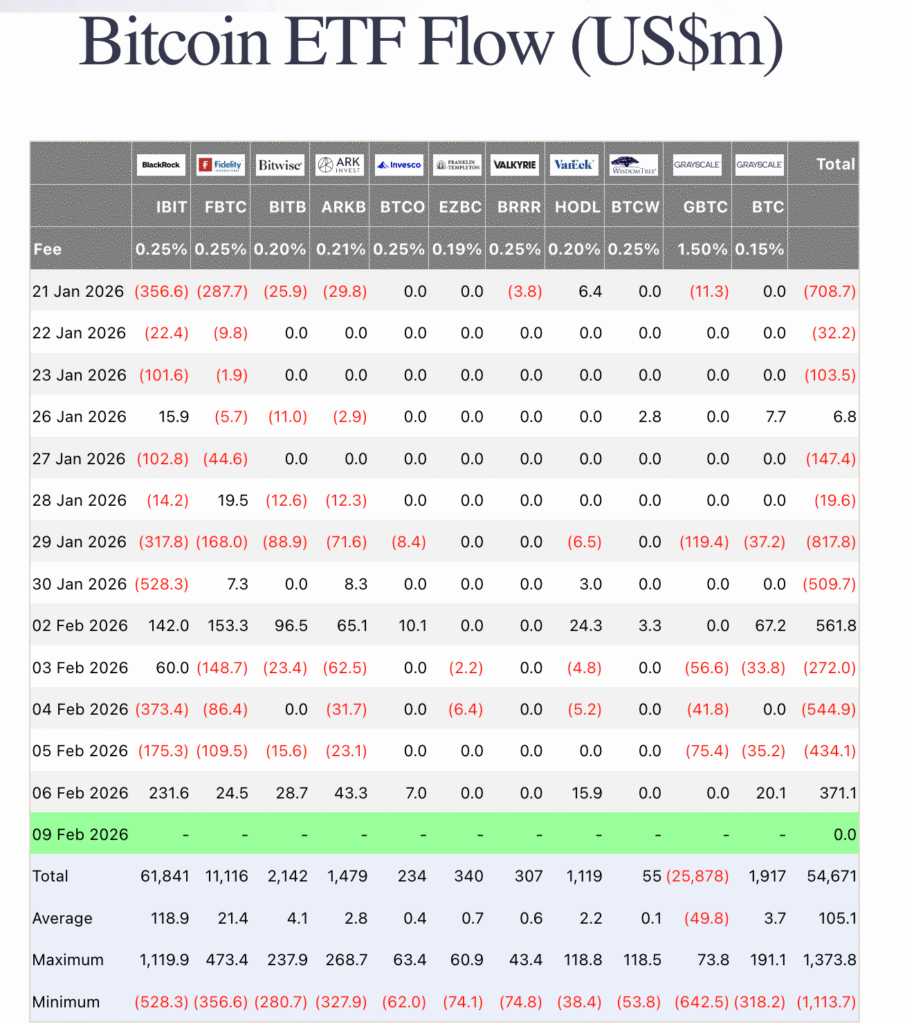

Bitcoin ETF Flows Improve, Conviction Lags

With ETFs, the big shift is simple: we moved from “yikes” to “mixed.” That’s better, and it absolutely helped mood. But mixed is still not the same as strong, trend-confirming demand. If flows were truly back in risk-on mode, we’d expect cleaner upside follow-through instead of this stop-start behavior.

When flows are mixed, price usually gets moody: hard green days, hard red days, no chill in between. Great if you like volatility. Annoying if you want trend clarity. That’s why ETF flow data matters — it shows whether capital is actually committing, not just reacting to noise.

Right now the tape says “improving, not resolved.” That’s useful, because it keeps us honest. If we start stacking strong net inflow sessions while BTC keeps reclaimed levels, risk appetite broadens fast. If not, rallies can still get sold into with almost zero remorse.

What to watch next: two to three strong net inflow sessions, plus BTC not instantly giving back reclaimed levels.

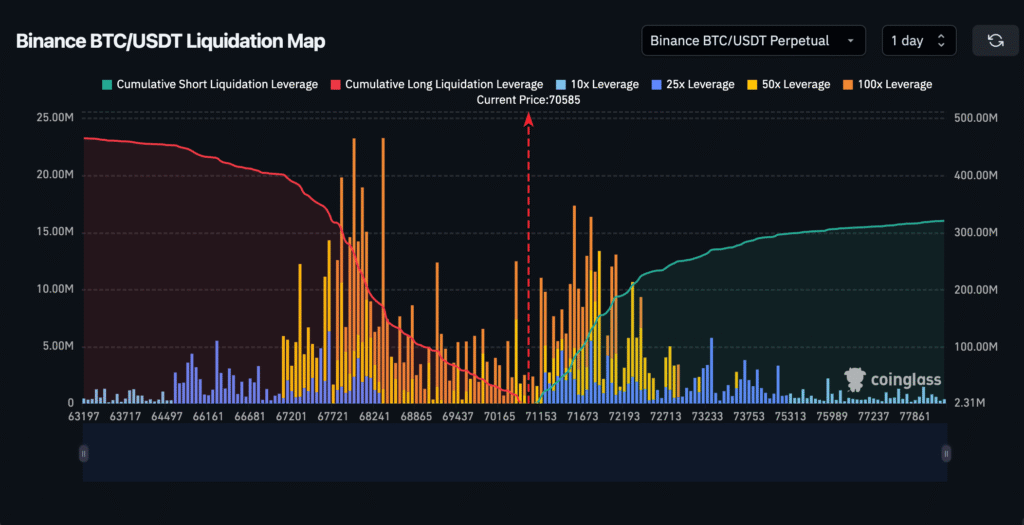

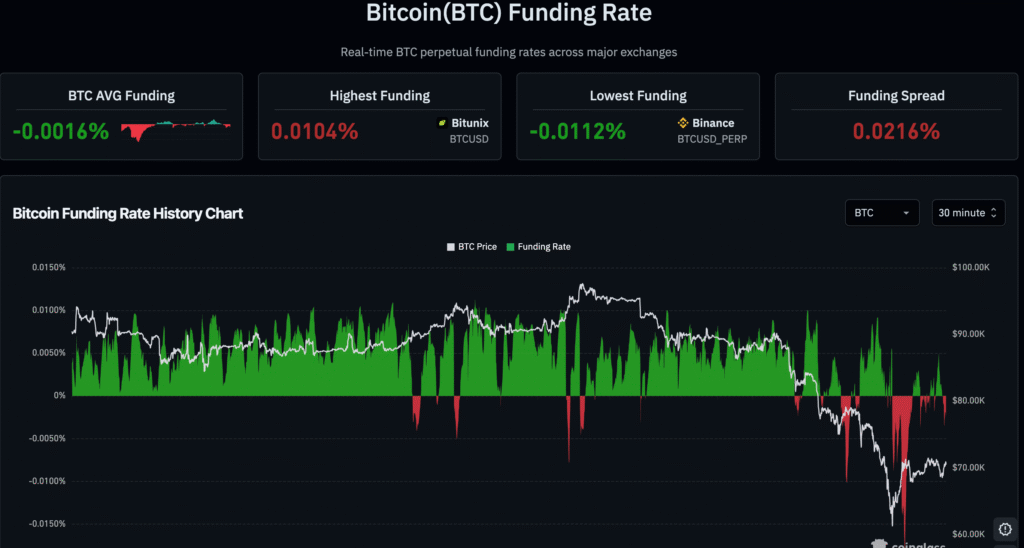

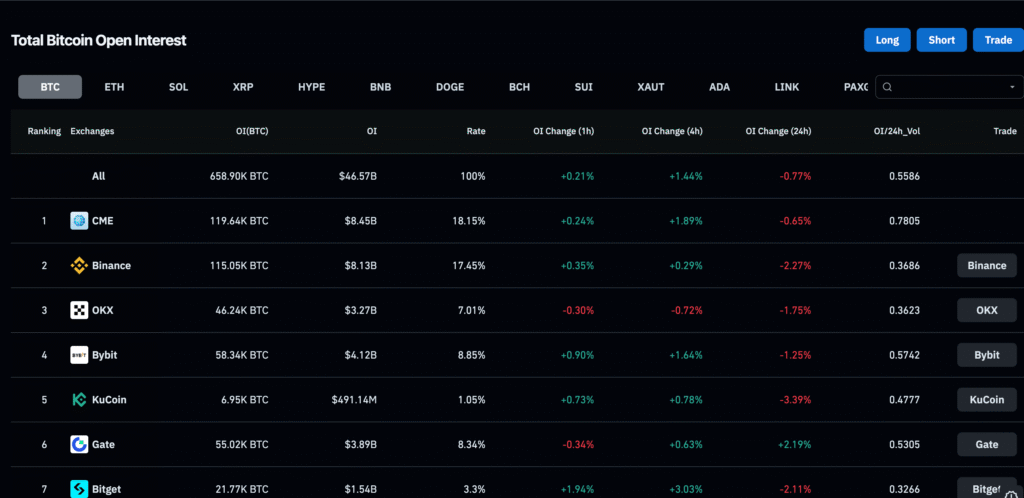

Funding and OI Still Signal Chaos

Derivatives are still yelling the same message: volatility first, trend second. Funding keeps flipping, OI resets keep showing up, and intraday reversals are still violent. That doesn’t mean upside is dead. It means breakout quality is shaky until spot participation actually deepens.

In this regime, breakouts can look legit for a few hours, then unwind the moment leverage gets rinsed. Classic trap setup: enough momentum to pull people in, not enough depth to keep continuation clean. We saw this kind of BTC squeeze before — and the rule still holds: trust follow-through, not first impulse.

A healthier setup is straightforward: OI rising with spot volume while funding stays stable, not euphoric. Until then, squeeze risk stays high in both directions, and every “clean breakout” deserves at least a little side-eye.

What to watch next: OI up + spot up + funding stable. If OI climbs while spot participation fades, this still breaks easy.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

If this helped you cut through the noise, join hundreds of readers who get Byte & Block in their inbox every morning

Subscribe to our newsletter!

Telegram Bot

Telegram Bot