🍪 News Byte – 06.02.2026

By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- This BTC Drop Felt Forced

- Gemini Quietly Pulls Back Globally

- Miners Feeling the Pressure Again

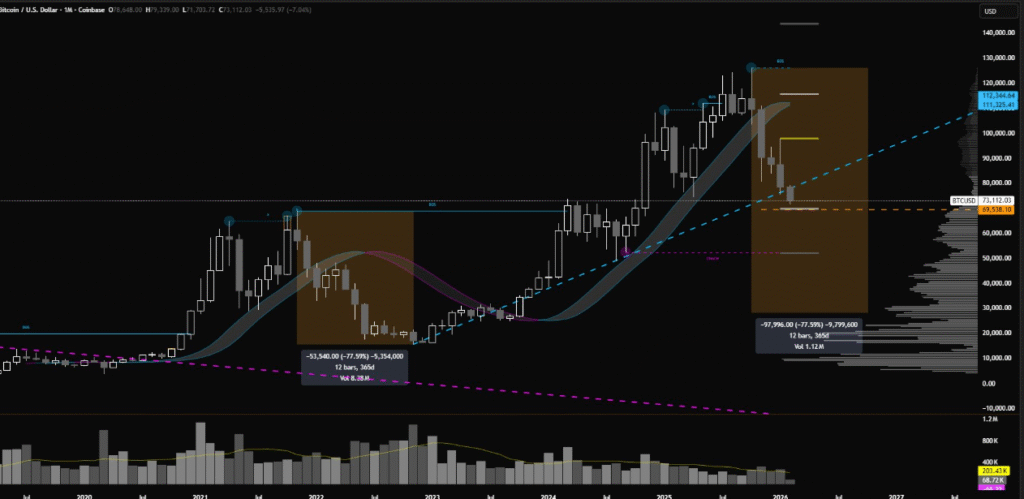

Unfinished Business Below $70K

Something about this BTC move feels… forced.

This wasn’t a slow bleed. It wasn’t even a clean panic. It was fast, messy, and very Asia-session heavy — the kind of move where price doesn’t decide to go down, it just falls through the floor because nobody’s really there to catch it.

BTC slicing through $70K like it wasn’t even a level should make people uncomfortable. Not because $70K is magic — but because that level had memory. It had defenders. And suddenly, it didn’t.

What’s interesting is how quickly the narrative jumped to “macro” and “risk-off.” That feels lazy. Risk-off doesn’t usually look like a straight-line drop followed by violent whipsaws and a $700M wipeout. That looks more like someone getting squeezed out of a position they couldn’t unwind cleanly.

The other weird thing: liquidity just vanished. Not thinned — vanished. That’s usually not retail. Retail panics are noisy. This was quiet, sharp, and mechanical.

Now you’ve got traders sniffing around for a hidden blowup, and honestly… that makes sense. Because when price behaves like this, it’s often not about fear — it’s about obligation. Someone had to sell. And when that happens, levels stop mattering.

The bounce back above $65K doesn’t really change that. It helps sentiment, sure. But rebounds after forced selling are common. The real question is whether the seller is done — or just paused. Mr. PermaBear doesn’t seem to think so…

If this was truly “just” macro pressure, the move wouldn’t have been this violent. And if it was just leverage, the market wouldn’t still feel this jumpy afterward.

This feels unresolved.

And unresolved markets have a habit of revisiting the scene of the crime.

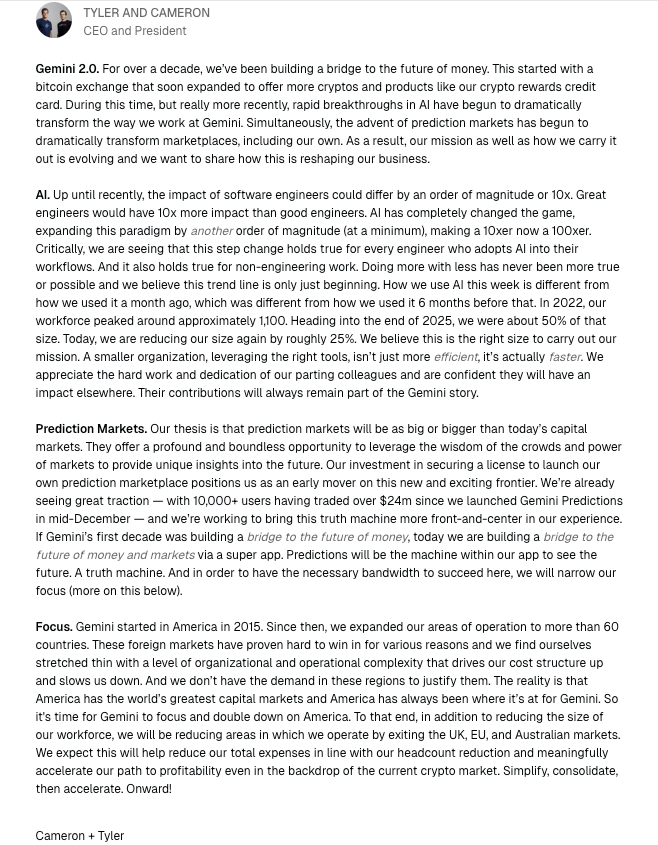

Gemini Pulls Back

This one feels quieter than it should.

That usually means one thing: the juice isn’t worth the squeeze anymore.

Running an exchange across multiple regions right now is a grind. Every market wants something slightly different. More reporting here. Different licensing there. Constant back-and-forth, with the threat of enforcement never really leaving the room. At some point, you stop expanding and start choosing.

What makes the timing interesting is what happened just before this. This comes shortly after Gemini had the SEC lawsuit over its Earn product dismissed in the US. On paper, that should have been a relief moment. Instead, the next visible action is pulling back from multiple major jurisdictions.

That contrast matters.

Because it suggests the pressure didn’t go away — it just shifted. Clearing one legal front may have forced a harder look at the others. Running a regulated exchange today isn’t about where demand exists. It’s about where compliance risk is survivable. And right now, the UK, EU, and Australia appear to have landed on the wrong side of that internal calculation.

It might not be catastrophic — but it is revealing. It shows how thin the margin has become for centralized exchanges operating globally. Even large, well-capitalized names are quietly narrowing their battlefield.

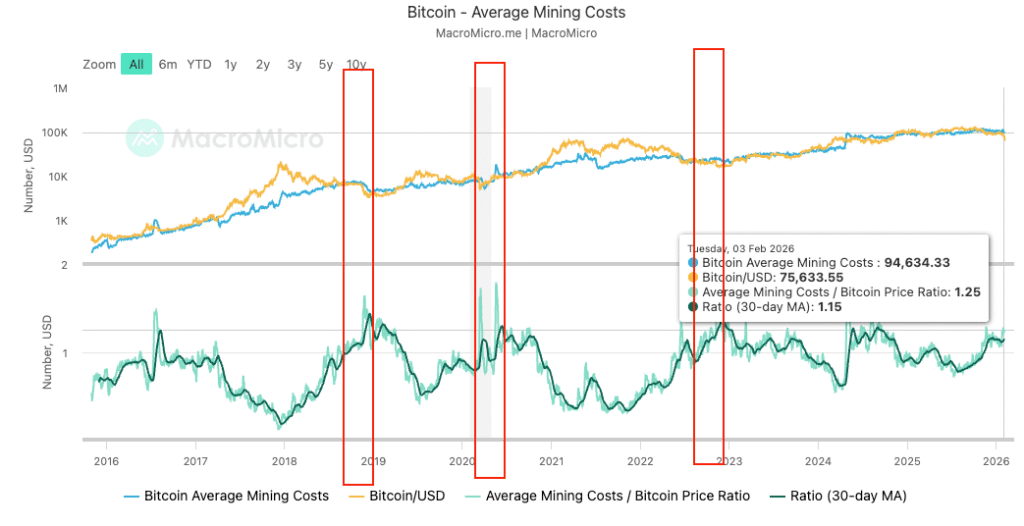

Miners Under Pressure + MARA Moves Coins

The miner tape is starting to look like the kind of thing people ignore… right up until it matters.

BTC trading below estimated production cost sounds academic, but history says otherwise. When margins compress, miners don’t just “feel pressure” — they get pushed into decisions. Hedge, borrow, dilute, or sell inventory. And when borrowing gets expensive and hedges are crowded, the boring option wins: sell.

We’ve seen this setup before.

In late 2018, BTC spent months below production cost. Price didn’t collapse immediately — instead, miners became steady sellers, keeping every bounce fragile until the pressure finally cleared. The same pattern showed up again in 2022, when high energy costs and forced liquidations turned miner wallets into persistent supply sources during the post-Luna and FTX unwind.

That doesn’t mean miners are “capitulating” today. It does mean the market is dealing with a familiar problem: supply that has to show up regardless of sentiment.

Recent large BTC transfers from public miners to desks and exchanges are why traders are watching this closely. Not because it guarantees another leg down — but because it explains why rallies feel thin, jumpy, and easily rejected.

This isn’t panic selling. It’s obligation selling.

And markets rarely resolve cleanly while that’s still in play.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

If this helped you cut through the noise, join hundreds of readers who get Byte & Block in their inbox every morning

Subscribe to our newsletter!

Telegram Bot

Telegram Bot