🍪 Daily Byte – 04.02.2026

By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- BTC Wobbles as Capital Rotates

- Tether Adjusts Ambitions Amid Pushback

- Burry Warning as Silver Cracks

Bitcoin Sinks, Ether & Alts Rebound

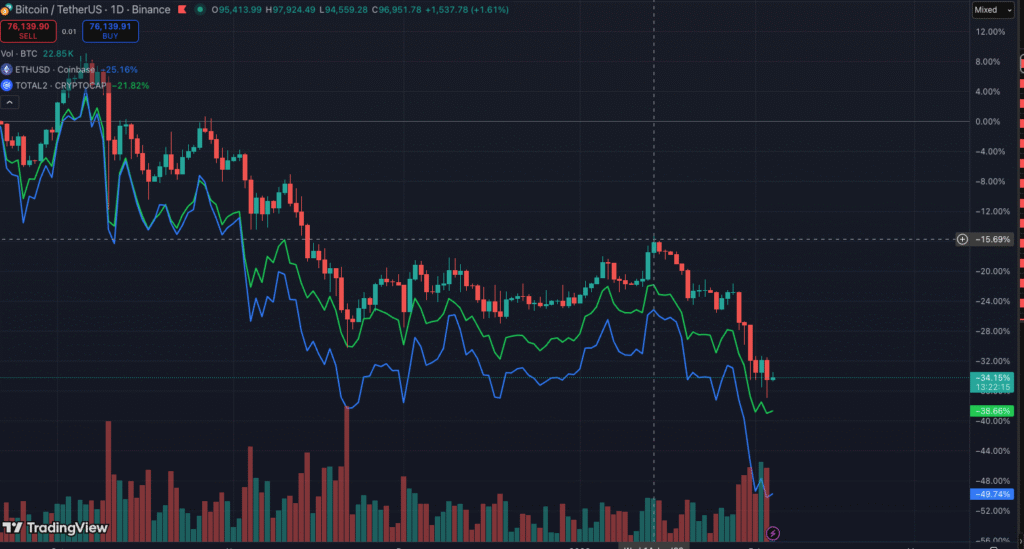

Bitcoin’s price continued to wobble in early February, sliding back toward key support levels around $74,000 after a notable sell-off across risk assets. BTC has retraced more than 40% from its late-2025 highs, with one-year lows near $74,700 amid broad market pressure.

That dip triggered sharp reactions: traders saw forced liquidations and a breakdown below technical levels that had offered support for much of the last quarter. Heavy selling pressure eroded bids below the $80,000 range, triggering stop-loss cascades before price briefly found a foothold nearer the mid-$70,000s.

But crypto markets aren’t a one-way street. In contrast to BTC’s struggles, Ether and other major altcoins have shown resilience, logging gains that reflect a rotation of capital within crypto risk markets. While Bitcoin bounced back to near $76,000, flows into majors beyond BTC suggest investors are broadening exposure despite the broader risk-off tone.

That bounce has come amid defensive positioning by institutional investors, with crypto investment vehicles recording net outflows — a sign that fear hasn’t fully lifted and that BTC’s recovery may be shallow.

On-chain, thinner liquidity and reduced depth on major exchanges have left BTC subject to outsized moves on relatively small order books. Analysts warn this dynamic keeps upside muted unless both macro sentiment and technical structure improve

Byte & Block’s takeaway?

Bitcoin is trading at depressed levels relative to late 2025, and although Ether and some altcoins have staged a short-term rebound, the overall picture remains cautious. Traders are now focused on whether the current bounce can stick above key resistance near $80,000, or if BTC will rotate back toward its lower support bands

Tether Cuts Back on Funding & Opens Mining Plans

Tether, the company behind the world’s largest stablecoin USDT, is scaling back one of its major funding ambitions after encountering resistance from investors, according to recent reporting. Plans that once targeted a $20 billion long-term funding allocation have been reduced amid pushback from the market. (This move signals a recalibration by one of crypto’s most influential issuers.)

The Tether strategy shift comes as investors have grown increasingly selective about where capital is deployed, especially in the context of heightened macro risk and liquidity concerns. Backers reportedly signaled that the size and structure of the proposed funding didn’t align with current market conditions, prompting management to reassess.

At the same time, Tether is pushing forward with plans to open-source certain aspects of its Bitcoin mining operations. The initiative aims to provide broader transparency around mining tooling and processes that Tether has developed, potentially allowing other operators and community developers to benefit from its infrastructure.

Though the funding pivot may signal caution, the open-sourcing move illustrates a two-pronged strategy: Tether wants to retain industry leadership while also contributing to ecosystem tooling that could drive wider miner participation and decentralization.

For holders of USDT and crypto investors more broadly, the combination of pulled-back funding ambitions and expanded technical disclosure offers a nuanced signal: reduced risk appetite meets strategic transparency. It’s a shift that reflects broader crypto market sentiment — one that’s more guarded than it was at the height of 2025’s bull run, but still engaged in long-term infrastructure play.

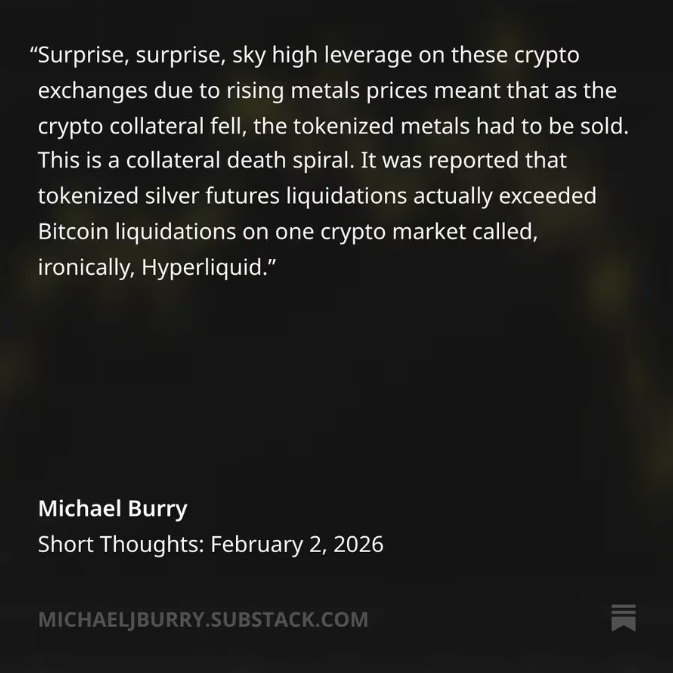

Michael Burry Flags Market Risks After Silver Outpaces Bitcoin

Michael Burry, the contrarian investor best known for The Big Short, has once again grabbed attention with a stark analysis linking precious metals markets to Bitcoin’s recent turbulence. Burry warned that liquidations in the silver market have outpaced Bitcoin’s own sell-offs, a dynamic he describes as part of a broader “death spiral” risk scenario for risk assets.

His commentary comes against a backdrop where both metals and crypto have experienced destabilizing flows, and where investor sentiment has become notably fragile. Burry’s argument, rooted in decades of market observation, posits that when commodities like silver face accelerated selling pressure — even relative to Bitcoin — it indicates systemic risk dynamics spilling across asset classes rather than isolated volatility in crypto or traditional markets.

Burry has historically been a skeptic of out-of-consensus asset rallies, and his view in early February suggests that interlinked deleveraging between metals and crypto futures could exacerbate downside pressure. The concern isn’t just price action itself, but the velocity and depth of liquidation events. If traders are forced out of positions across multiple risk markets simultaneously, liquidity drying up can compound drawdowns.

Byte & Block Takeaway

Although Bitcoin remains a distinct asset class with unique drivers, Burry’s perspective highlights the psychological and technical bridges forming between disparate markets. When capital flees momentum trades and speculative assets, correlations tend to blur — and assets like BTC, silver, and tech stocks can move more in tandem than fundamentals might suggest.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

If this helped you cut through the noise, join hundreds of readers who get Byte & Block in their inbox every morning

Subscribe to our newsletter!

Telegram Bot

Telegram Bot