News Byte – 11.02.2026

By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- ETF Relief Meets Resistance Reality

- Memecoin Rotation Is Back

- Speculation “Over” Narrative vs. Real Test

ETF Relief Meets Resistance Reality

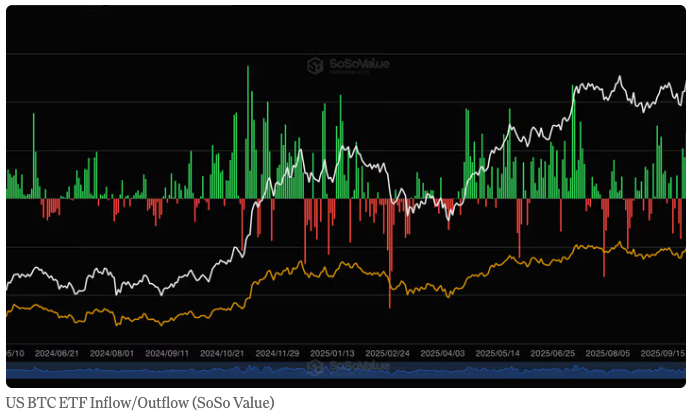

ETF bulls finally got something they can point to without squinting: two green flow days in a row. Good signal, sure — just not an automatic “up only” pass. Price still looked like a market that wants more proof before it fully commits.

The tape had that early-repair feel: better data, still jumpy candles, confidence not fully there yet. That combo shows up when positioning is healing faster than conviction.

One easy mistake here is treating every positive ETF print as equal. It isn’t. What matters is whether inflows stick around during chop, not just after green candles. Sticky inflows usually mean stronger hands stepping in. Reactive inflows can disappear as fast as they arrived.

You can see this pattern in the ETF flow regime framework: when demand is real, pullbacks get bought and reclaimed levels hold. When demand is thin, rallies look great for a few hours and then run out of oxygen.

That Hougan/Balchunas split is a useful tell too: institutions keep leaning in while parts of crypto-native flow still hesitate. Both can be true at once, and when they are, markets usually chop before they trend.

Here’s what matters this week: if BTC keeps printing higher lows while flows stay net-positive, confidence can build fast. If U.S. strength keeps getting faded cross-session, stay cautious. Progress is real — conviction still needs to earn it.

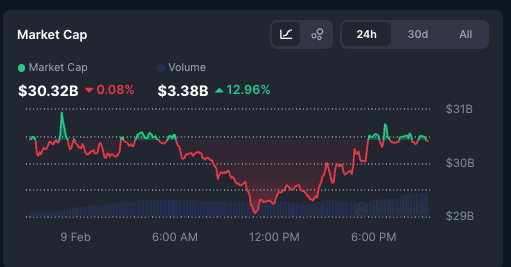

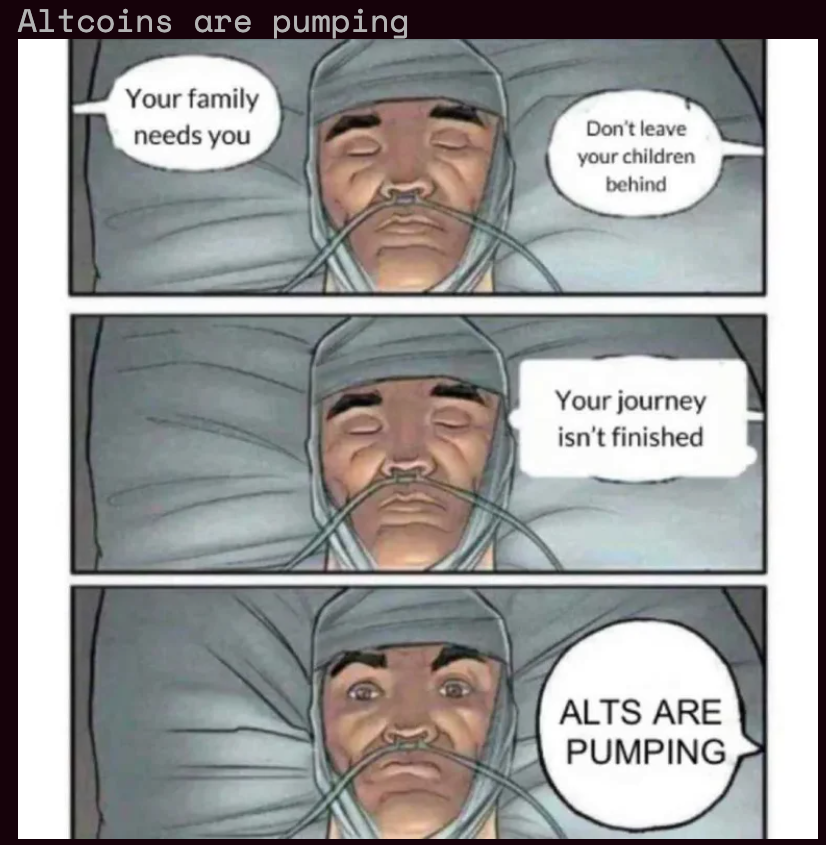

Memecoin Rotation Is Back, but Narrow

Memecoins ripping while BTC/ETH move slower is exactly the kind of split tape that tricks people into getting bullish too early.

The real question is breadth: is this actually spreading, or is it just hot money sprinting inside one narrow pocket?

To avoid narrative drift, compare memecoin strength against majors on the same window. If the spread stays extreme while BTC/ETH remain soft, it is usually a selective chase, not broad health.

This maps cleanly to the framework from our 2026 altseason condition check: true expansion needs participation depth, not just one hot corner printing green candles. Right now, we clearly have energy, but it is concentrated.

There is also a market-structure angle. In our CME-vs-Binance derivatives note, we flagged that leverage leadership has been shifting toward more structured flows. That can coexist with memecoin bursts, but it often caps how far pure reflex mania can run without broader confirmation.

My practical read: respect the move, don’t romanticize it. Great trade if you’re selective, painful if you chase late and call it a regime shift. If breadth improves across majors and second-tier alts, this story upgrades. If it stays concentrated in one lane, keep expectations tactical and time horizons short.

Speculation “Over” Narrative Faces a Real Test

“Speculation is over” is a clean headline, but the tape still looks too mixed for a final verdict.

At the CNBC’s digital finance forum in New York, Mike Novogratz framed this phase as a post-washout market getting more disciplined after repeated leverage resets.

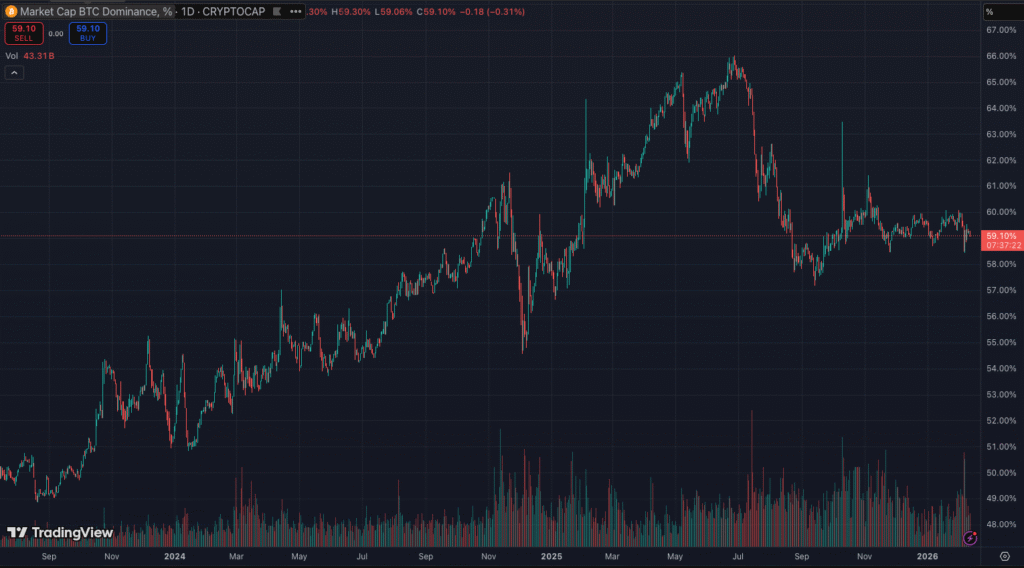

If the thesis is right, BTC dominance should keep rising while lower-quality breadth thins out. If the thesis is too early, risk appetite will re-expand quickly into high-beta pockets and dominance will stall.

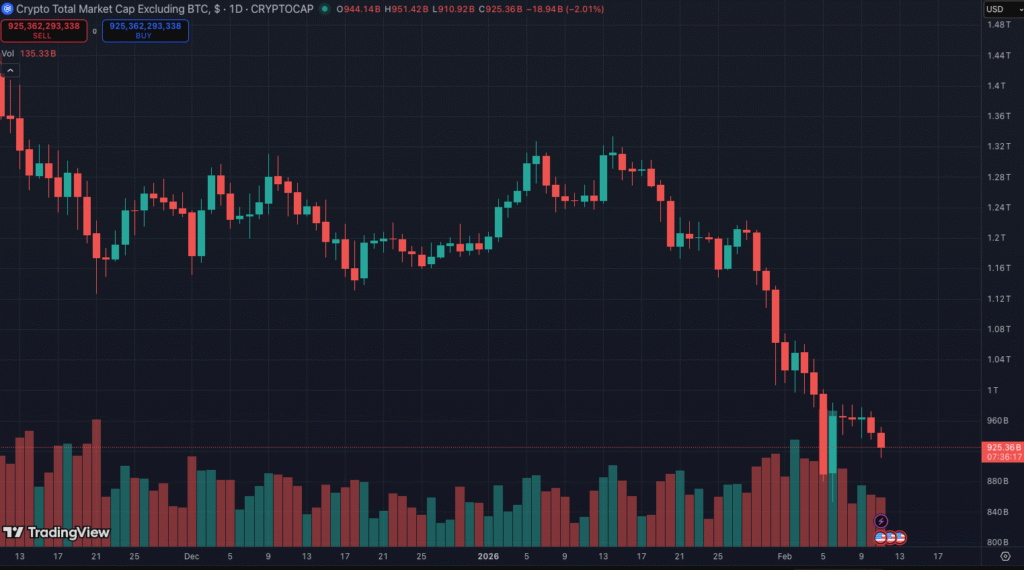

Then pair that with TOTAL2, because breadth is the stress test. If ex-BTC market cap keeps sagging while dominance climbs, “cooling speculation” gets stronger. If TOTAL2 re-accelerates, the market is still rewarding selective risk-taking.

This is consistent with what we laid out in the altseason prerequisites framework: regime calls only hold when macro, breadth, and dominance align at the same time. One signal in isolation is noise-friendly; aligned signals are what deserve conviction.

Bottom line: speculation isn’t dead — it’s just being repriced and filtered harder. That’s a real shift, just not a full funeral. The practical playbook is simple: when dominance, breadth, and macro all point the same way, you can press with more confidence. When they diverge, reduce size and treat strong narratives as provisional, not gospel.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

If this helped you cut through the noise, join hundreds of readers who get Byte & Block in their inbox every morning

Subscribe to our newsletter!

Telegram Bot

Telegram Bot