By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- BTC Dumps below 90K

- Crypto Market-Structure Bill Is About to Pass

- US–China Trade Deal

Fear & Greed Index Today

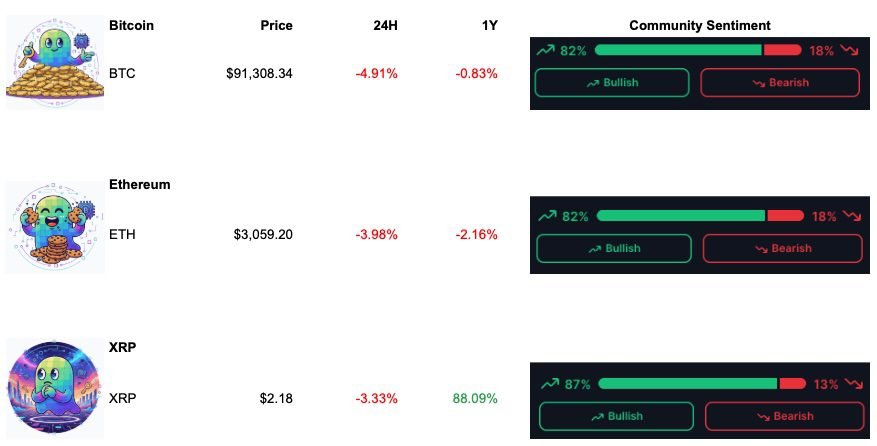

Prices as of 09:00 AM CET

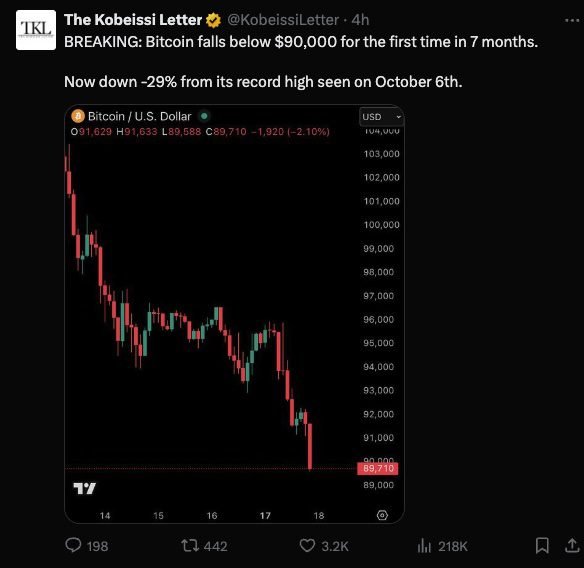

📉 Bitcoin Dumps Below $90K… But the Cycle Isn’t Done

Bitcoin plunged below $90,000 for the first time in seven months, erasing its 2025 gains and marking a ~30 % drop from its October peak, amid worries about delayed U.S. rate cuts and fading investor appetite

The swift breakdown suggests crypto is behaving more like a high-beta tech asset than a diversification hedge—once the macro tide turns, it may turn quickly.

Despite the slump, MicroStrategy and key institutional holders are buying Bitcoin into the sell-off—one firm disclosed buying ~8,178 BTC at an average price over $102k recently

Contrarian accumulation often shows up at market bottoms. Big players buying when the crowd is fleeing could hint at a shift in supply dynamics—even if for now the trend remains down.

The drawdown feels dramatic — but it’s actually a textbook mid-cycle flush. Unless this is the first cycle in history to top early, BTC likely has another major leg ahead. Corrections rarely break cycles; they often reset them. Bitcoin looks more like it’s finishing a shakeout phase than beginning a macro collapse.

Some voices in the space even “nervously” predict a new ATH by the end of the year

Historically, Bitcoin peaks 12–18 months after the halving — not 7 months after. In previous cycles (2013, 2017, 2021), BTC had at least one major rally left after similar mid-cycle corrections.

🚨 US Confirms Trade Deal With China to Be Signed by Nov 27 🇺🇸🇨🇳

A US–China trade agreement is reportedly set to be signed by November 27, according to circulating industry reports amplified by DeFiTracer and CryptoRover.

If finalized, the deal would reopen major export channels and potentially inject up to $1.5 trillion in liquidity back into global markets through cheaper cross-border trade, reduced tariffs, and supply-chain normalization.

Why This Matters for Crypto:

A large macro liquidity wave — especially one triggered by a US–China trade thaw — historically fuels risk assets first. When liquidity expands, capital tends to flow into:

• equities

• commodities

• and yes, crypto

With BTC already oversold and trading near $93k, macro relief could amplify a rebound.

Crypto often reacts before traditional markets when liquidity expectations shift. If this deal materializes, it could flip sentiment quickly: fear → relief → risk-on rotation. But traders should be cautious — until the deal is officially signed, this remains a macro catalyst, not a guarantee.

Coinbase CEO Signals Crypto Market-Structure Bill Is About to Pass

Coinbase CEO Signals Crypto Market-Structure Bill Is About to Pass

Brian Armstrong, CEO of Coinbase, told CNBC in a live interview that the U.S. crypto market-structure bill is now “90% done” and enjoys strong bipartisan momentum — he suggested the legislation could pass by Thanksgiving. The proposed bill aims to clarify the regulation of exchanges, tokens, custody, and stablecoins — with billions of dollars of institutional crypto capital potentially waiting in the wings.

If this landmark legislation clears the Senate, it could unlock a wave of institutional allocation into crypto by removing regulatory uncertainty. However the final 10% — which includes DeFi carve-outs, token definitions and agency jurisdictions — could still introduce last-minute risk or compromise.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

Subscribe to our newsletter!