By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- BTC Drops to 93K

- Japan Redrawing Its Crypto Rulebook

- 95% of all BTC blocks have been mined

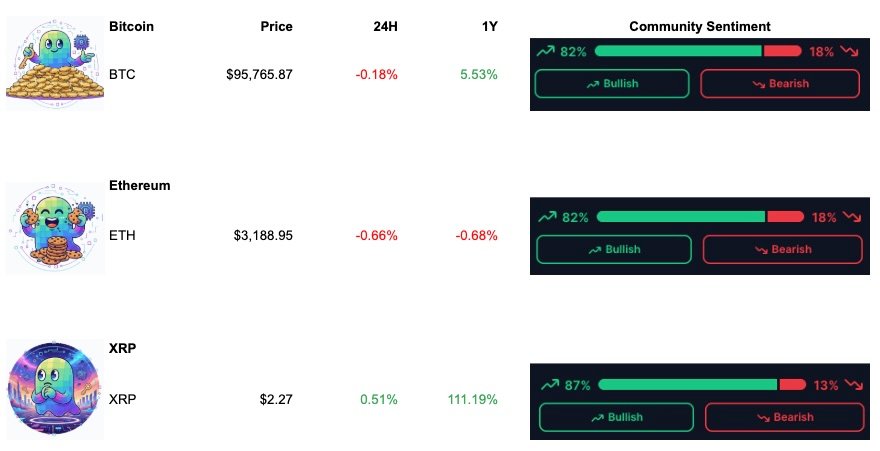

Fear & Greed Index Today

Prices as of 09:00 AM CET

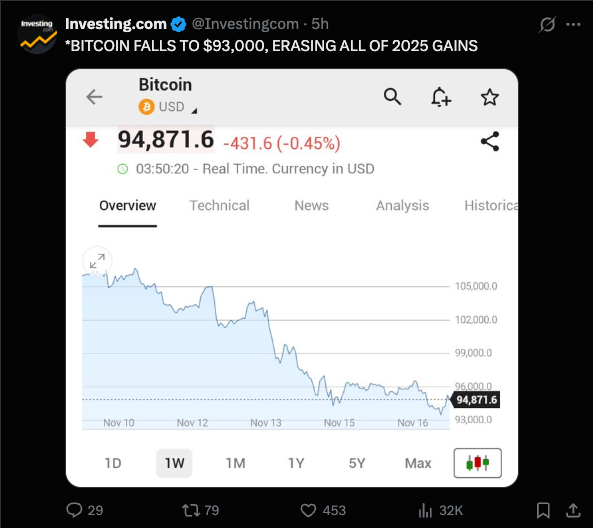

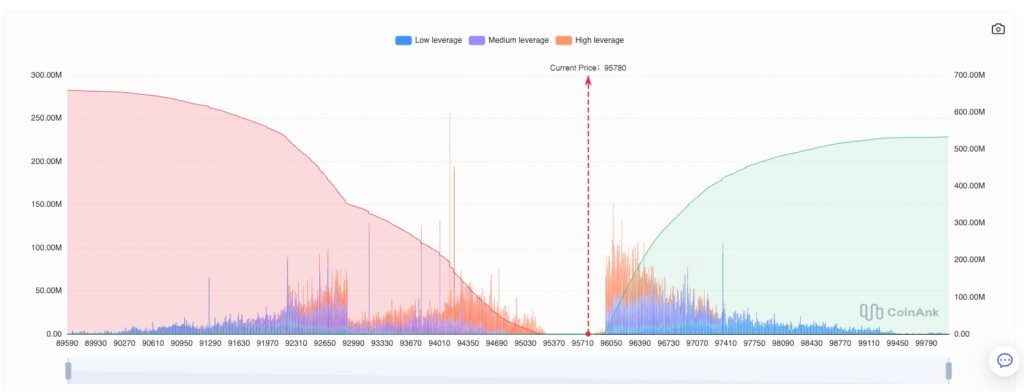

📉 Bitcoin Drops to ~$93K — Worst Week Since March. Possible Short-Squeeze?

Bitcoin slid toward $93K, extending a multi-day correction that has now become BTC’s worst week since March. Analysts cite a combination of factors: tightening liquidity across risk markets, lower spot inflows, cooling momentum from AI/tech stocks, and signs of long-term holders trimming exposure.

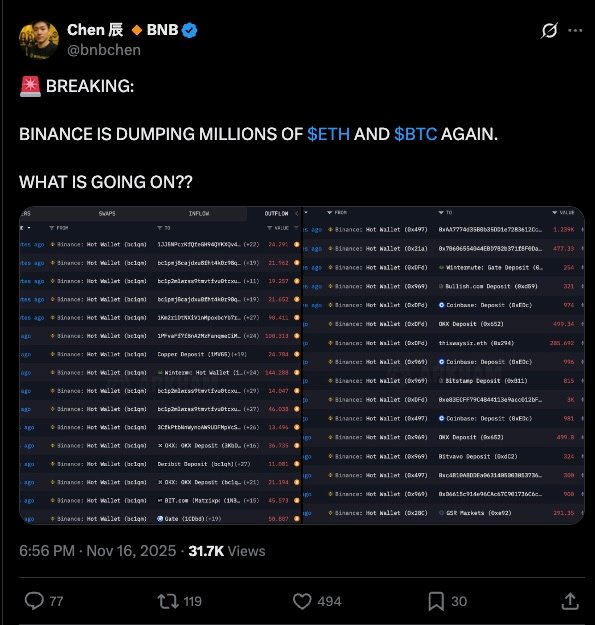

Some of the most notable being BlackRock, Binance and Greyscale:

Some see this is as a short-squeeze and once the shorts get liquidated, BTC will bounce back.

The dip has shaken trader sentiment — some worry this could deepen to mid-$80Ks, while others highlight that the market remains structurally strong. Funding has normalized, open interest is cooling, and forced sellers appear to be less impactful than earlier this year.

Some see this as a bear trap, with a medium term bounce-back and new ATH.

Everyone loves crypto until it dips — then the timelines turn philosophical. But zooming out, this correction fits perfectly into Bitcoin’s long-term rhythm: pumps → overheated leverage → flush → rebuild. Historically, this phase has often produced the best entries for the patient.

Truth is crypto bottoms never announce themselves. They form slowly, quietly, and often when everyone is convinced “it’s over.” Liquidity is like gravity — it eventually pulls price in its direction. If stablecoin buildup continues, the next strong leg may surprise the market.

🔥 Japan Is Redrawing Its Crypto Rulebook — And It’s Big 🇯🇵

Japan is preparing one of its most meaningful crypto overhauls in years. The Japan Exchange Group — home of the Tokyo Stock Exchange — is moving to reclassify cryptocurrencies as financial products, a shift that would bring them into the same regulatory bucket as traditional securities. The country is also preparing to reduce crypto taxation, lowering friction for both institutional and retail investors.

This is not a small tweak. Japan has historically taken a cautious yet pro-innovation stance since the Mt. Gox collapse. By modernizing definitions and lowering tax pressure, it signals a push toward legitimizing digital assets at the state level.

Japan isn’t just “opening the door.” It’s putting a welcome mat out for crypto capital. When major economies update classifications, it sets off a ripple effect — regulatory clarity invites institutions, and institutions bring liquidity.

₿₿₿ 95% of all Bitcoin have been mined

95% of all #Bitcoin has now been fully mined. That’s 19,950,086 $BTC out of the fixed 21 MILLION supply cap.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

Subscribe to our newsletter!