By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- Czech National Bank Just Bought $BTC

- Harvard increases it’s BTC ETF investment

- Bitcoin slides below $95K

Fear & Greed Index Today

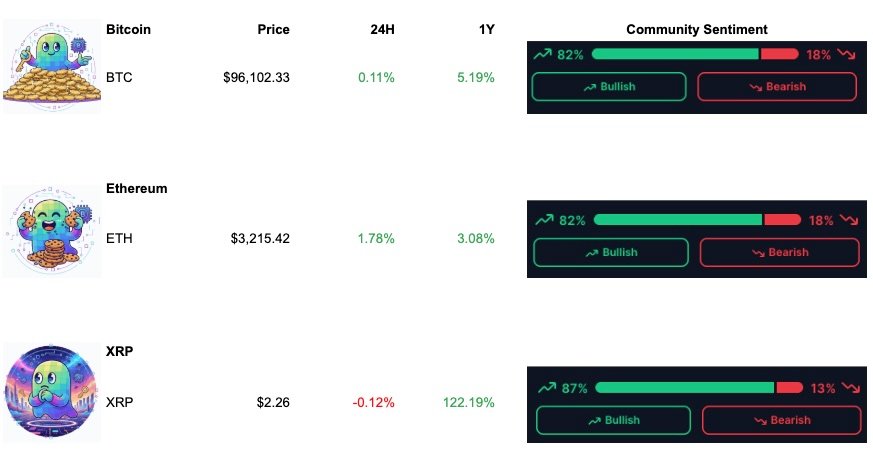

Prices as of 09:00 AM CET

🔥 Czech National Bank Just Bought $BTC – Here’s Why This Is a Big Deal 🇨🇿

The Czech National Bank has officially dipped its toes into digital assets, launching a $1 million pilot portfolio that includes Bitcoin, a USD-backed stablecoin, and a tokenized deposit.

Yes — a European central bank is now actively experimenting with blockchain-based assets.

What’s the point?

The CNB wants real, practical exposure to buying, storing, and handling digital assets. Over the next 2–3 years, the bank will publish its findings — everything from custody workflows to risk frameworks — as part of a larger investigation into how blockchain might influence the financial system of the future.

The pilot, approved on October 30, is strictly exploratory. It’s not part of the country’s official reserves, and the initial allocation is capped.

Governor Michl summed it up clearly:

“We wanted to test decentralized bitcoin from a central bank’s perspective and assess its role in diversifying reserves.”

🧠 Harvard Makes $443M Bet on Bitcoin via BlackRock’s IBIT

Harvard University’s endowment has disclosed a $443 million stake in BlackRock’s iShares Bitcoin Trust (IBIT), making a spot bitcoin ETF its largest reported equity holding, per its latest 13F filing.

The fund holds 6.8 million shares, representing just over 20% of Harvard’s U.S.-listed public equities — an unusually heavy weighting for an endowment that typically avoids ETFs in favor of private markets and direct investments.

While the position is under 1% of Harvard’s $55B endowment, it places the university among IBIT’s top 20 holders. The filing arrives during a week when bitcoin slid more than 5% to about $96K, underscoring Harvard’s long-term conviction.

📉 Bitcoin slides below $95K amid worst week since March — Analyst sets downside target at $84K.

Bitcoin dropped under $95,000 this week, triggering its weakest 7-day performance since March. According to analysts, critical support has now flipped, and one sees the next major floor around $84,000 if selling persists. On-chain data shows long-term holders are reducing exposure at higher cost bases, while funding rates across major exchanges have turned negative, signalling a growing shift from “buy the rips” to “hedge the breaks.” With broader risk-assets under pressure and crypto unique flows weakening, the market appears to be in a gravity-phase rather than a momentum phase.

When Bitcoin journeys from hype-driven rallies to support-driven defend zones, the opportunists appear — not the spectators. We’re now in phase two of the cycle.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

Subscribe to our newsletter!