By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- BTC breaks support

- The US Gov reopens.

- Institutions Quietly Position

Fear & Greed Index Today

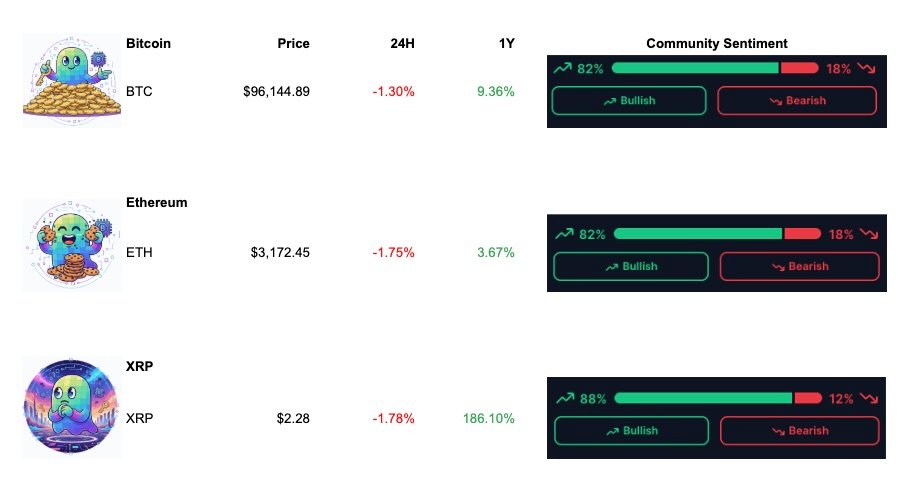

Prices as of 09:00 AM CET

📉 Bitcoin Breaks Key Support as Selling Accelerates

BTC fell below major support levels (~$100k → $97k zone), with long-term holders selling ~815,000 BTC over the last 30 days — one of the largest LTH distributions reported this cycle.

Why is this happening?

On-chain data shows long-term Bitcoin holders (those with coins >155 days) are distributing heavily – roughly 815,000 BTC sold in the past 30 days, the highest since Jan 2024.

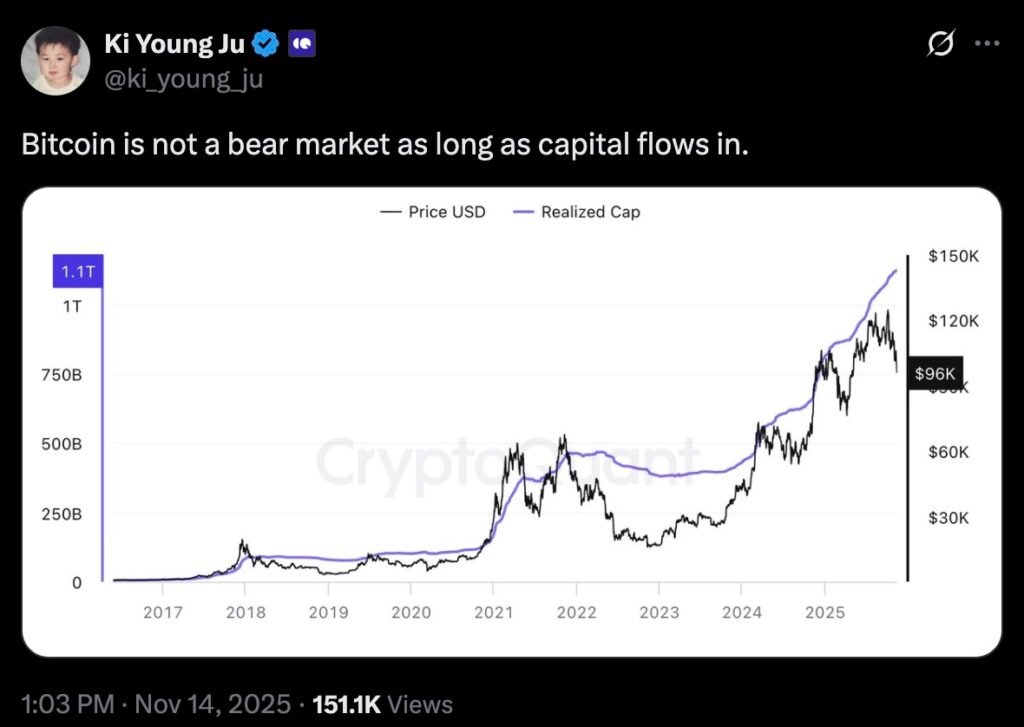

At the same time, liquidity has tightened. While the recent US government shutdown just ended, it forced ~$200 billion out of circulation, creating a vacuum in market flows which have not re-entered the markets.

All these create conditions for a market pull.

Crypto has always been cyclical. Moments like these feel brutal — but historically, deep red phases and forced selling often marked the middle of a cycle, not the end.

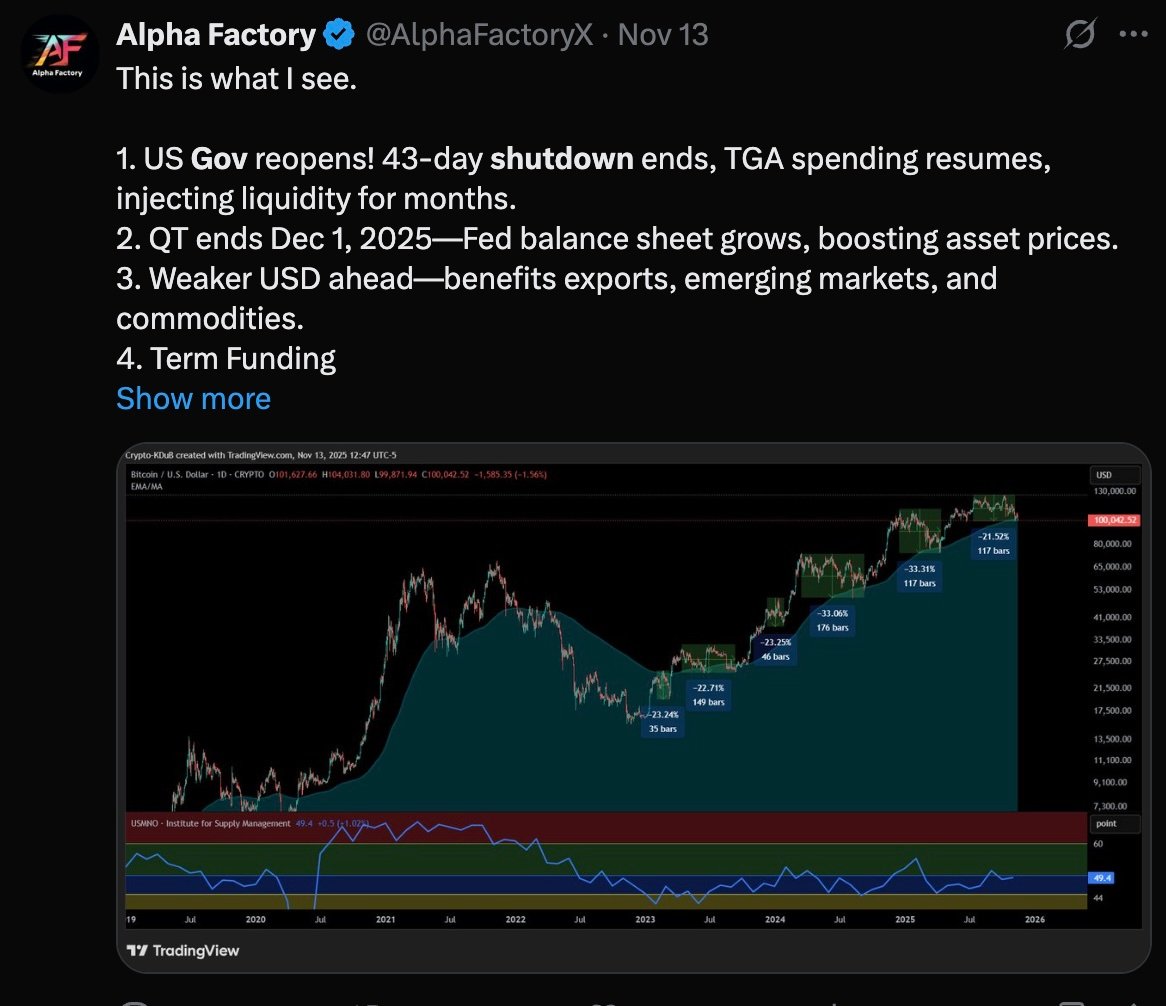

🥐 2.2 US Government Reopens

The shutdown is over. Federal spending restarts, delayed data comes in, and markets reassess.

Some crypto assets bounced on shutdown-ending headlines; others are still digesting the macro picture.

Crypto tends to behave like a liquidity barometer. Shutdown = liquidity freeze. Reopening = slow thaw. Not instant fireworks — just one less headwind.

🧺 2.3 Institutions Quietly Position (BlackRock)

BlackRock’s markets team highlighted increased institutional allocation to digital assets as portfolios rebalance toward alternative stores of value amid macro volatility.

Institutions don’t “buy the hype.” They accumulate when macro uncertainty is high and valuations reset. Today’s pain tends to be tomorrow’s narrative — again, not advice, just historic pattern.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

Subscribe to our newsletter!