By Byte & Block — exploring the building blocks of digital finance.

Today’s Menu:

- BTC slips under 100K.

- The U.S. shutdown finally ends.

- 21Shares sneaks crypto baskets into mainstream ETFs.

Fear & Greed Index Today

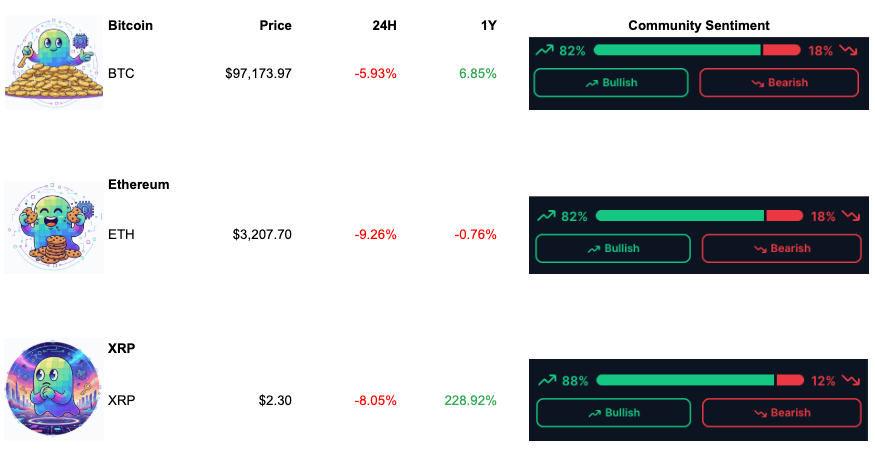

Prices as of 09:00 AM CET

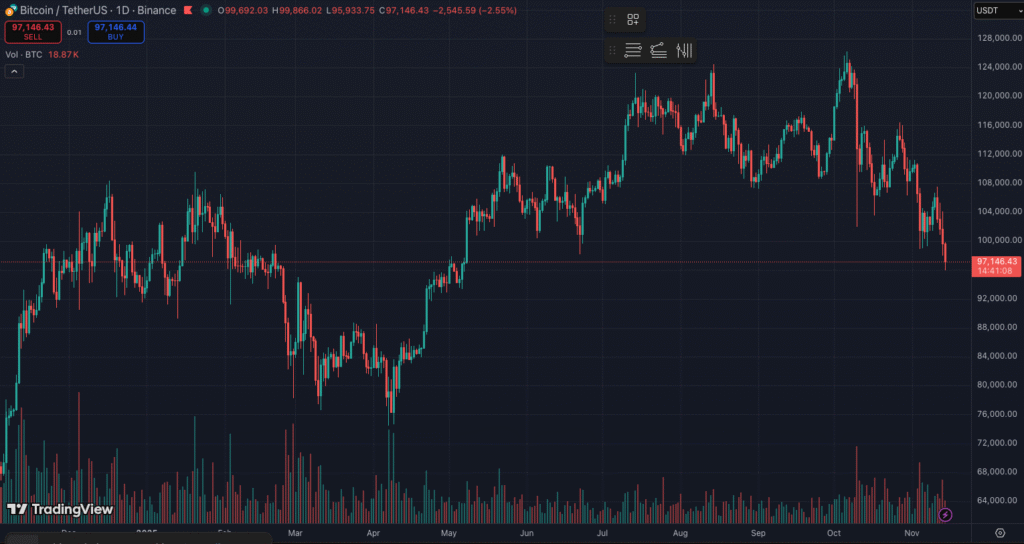

🍫 2.1 Bitcoin Breaks Below $100K

BTC dropped roughly 4% in 24 hours and traded around $97k, snapping the $100k psychological line and extending the drawdown from October’s highs. Sell-offs hit other majors as well, with analysts flagging increased volatility and fragile sentiment.

When long-term holders start selling into a macro shock, it usually means the market is repricing risk, not “dying” — pain now, but it often sets up cleaner accumulation zones later.

🥐 2.2 Shutdown Over — Liquidity Thaw Begins

After a record-long 40+ day shutdown, the U.S. government has reopened. Federal workers get paid again, delayed economic data can be released, and markets are re-pricing what renewed spending plus Fed policy might look like. This will only last for a couple of months though as on January 30 2026 we will be facing the same issue.

Some crypto assets bounced on shutdown-ending headlines; others are still digesting the macro picture.

Shutdowns matter for crypto because they freeze liquidity. Treasury’s cash balances ballooned while spending paused; as that reverses, dollars slowly flow back into the system. Crypto tends to behave like a high-beta liquidity barometer: when money moves, so do risk assets. The key now isn’t “shutdown over = moon,” it’s how fast the tap opens and how the Fed reacts to the fresh data.

🧺 21Shares’ Crypto Index ETFs — Boring Wrapper, Big Impact

21Shares has launched two U.S.-listed crypto index ETFs — FTSE Crypto 10 Index ETF (TTOP) and FTSE Crypto 10 ex-BTC Index ETF (TXBC) — both structured under the Investment Company Act of 1940. Instead of tracking just one coin, they follow diversified baskets including ETH, SOL, DOGE and other majors.

This is a quiet but big shift: instead of single-coin degen bets, you now have regulated, diversified crypto index funds in the U.S. under the same law that governs most mutual funds — the sort of wrapper pensions, RIA platforms and conservative wealth managers are comfortable using.

Meme of the day

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

Subscribe to our newsletter!