By Byte & Block — exploring the building blocks of digital finance.

The Biggest Shift You’ve Never Noticed 🪙

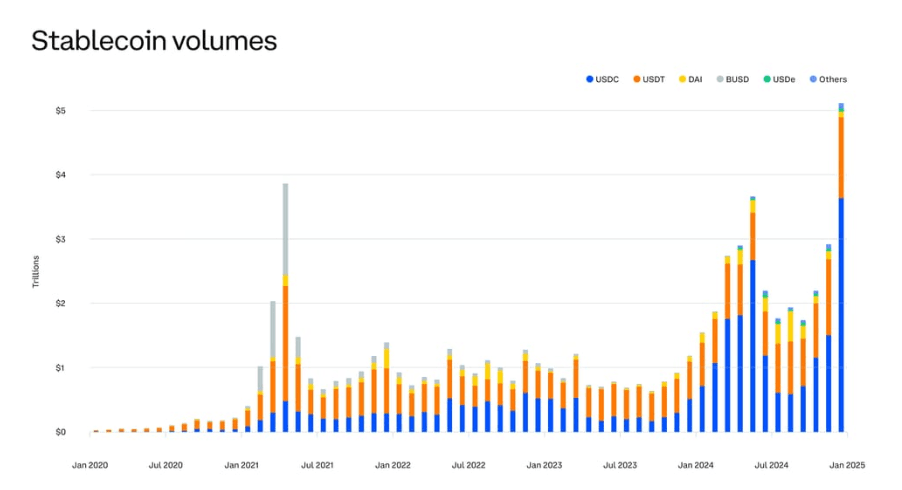

Every day, trillions of dollars quietly move through the internet — not through banks, but through digital tokens called stablecoins.

In 2024 alone, the total stablecoin transaction volume exceeded $9 trillion — more than Visa, Mastercard, and PayPal combined 💸🤑💰.

And yet, most people still don’t know what they are or why they matter.

This isn’t a story about speculation.

It’s a story about the plumbing of the digital economy — and how a subtle innovation in crypto is reshaping how money moves globally.

🏦 1. What Are Stablecoins?

Stablecoins are digital tokens designed to hold a stable value, usually pegged to a major currency like the U.S. dollar.

Unlike Bitcoin or Ethereum, they’re not meant to fluctuate wildly — 1 token ≈ $1.

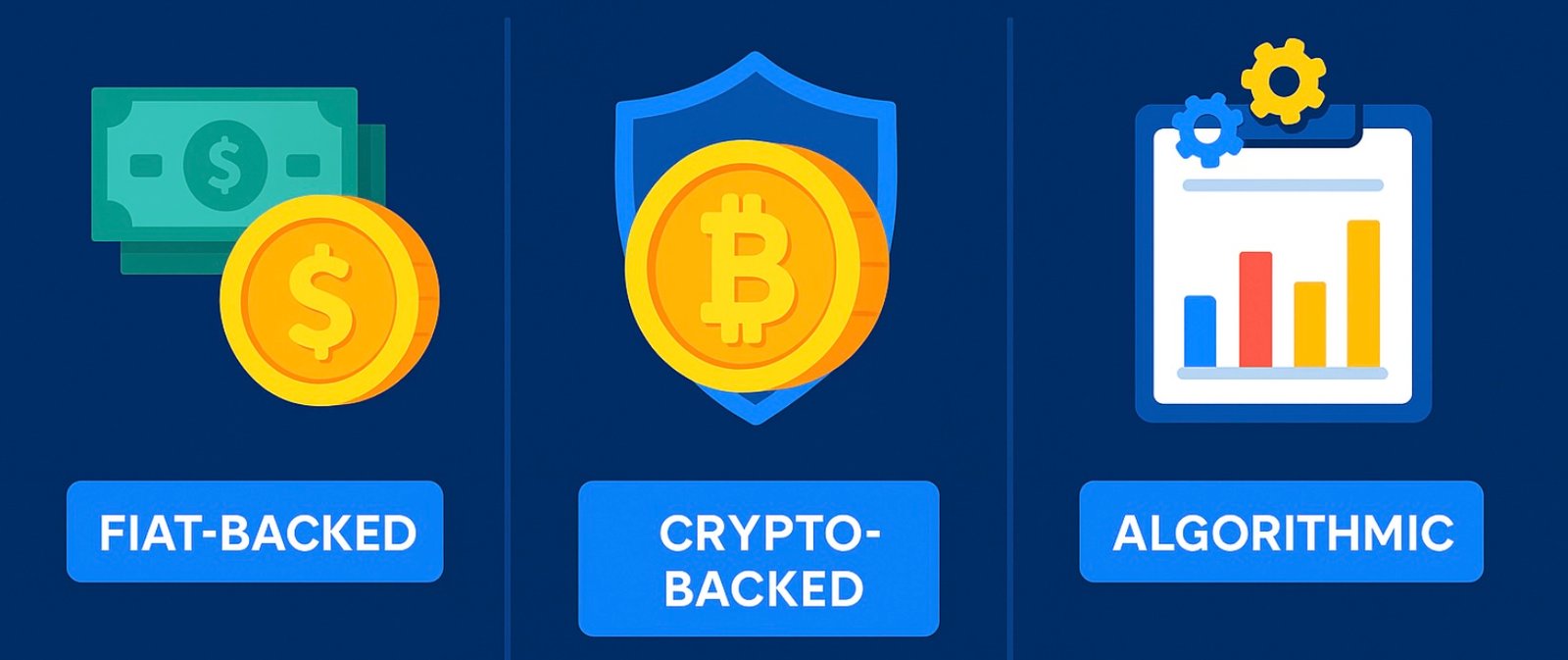

There are a few main types:

- 💰 Fiat-backed: Each coin is backed by real cash or short-term U.S. Treasuries held by a company (e.g., USDC by Circle, USDT by Tether).

- ₿₿ Crypto-backed: Collateralized by other cryptocurrencies locked in smart contracts (e.g., DAI).

- 🧊 Algorithmic: Maintain stability through supply and demand algorithms — a model that’s largely experimental after high-profile failures.

Together, these digital dollars act as the bridge between traditional finance and crypto ecosystems..

🌍 2. Why They’re Useful (Even Outside Crypto)

TStablecoins are faster, cheaper, and more flexible than traditional money transfers.

They’ve found use cases far beyond speculative trading:

- Remittances: Instant cross-border payments without banking fees.

- DeFi & Web3 apps: The native “cash” of decentralized finance.

- E-commerce: Growing acceptance among fintech platforms for borderless digital payments.

- Business-to-business transactions: Used by startups and even some institutions for 24/7 settlement.

In countries with unstable local currencies, stablecoins have quietly become a digital escape valve — a way to hold dollar value without relying on local banks.

💹 3. The Growing Role in Global Finance

Stablecoins are no longer fringe crypto tools — they’re now part of the global financial conversation.

Governments and regulators are paying attention:

- The European Union’s MiCA regulation sets new transparency standards for issuers.

- The U.S. continues to debate federal oversight, with multiple bills on stablecoin reserves and disclosures.

- Meanwhile, emerging markets are adopting them as unofficial digital dollars.

Some governments are even building their own blockchain-based currencies — CBDCs (Central Bank Digital Currencies) — inspired by what stablecoins already proved possible.

Stablecoins may be privately issued, but they’re setting the blueprint for how programmable money works at scale.

⚖️ 4. The Risks and Realities

For all their promise, stablecoins aren’t risk-free.

Their “stability” depends on trust and transparency — that issuers actually hold the reserves they claim.

Key challenges:

- Regulatory gray zones: Rules differ across jurisdictions.

- Transparency: Not all issuers publish frequent or audited reserve reports.

- Depegging events: Rare, but possible if collateral loses value or confidence drops suddenly.

The takeaway? Stablecoins aren’t replacements for fiat currencies yet — but they’re proving what’s technically and economically possible.

🧠 5. The Takeaway: The Infrastructure of the Internet of Money

Stablecoins represent a quiet but foundational change:

they’re turning money into software — fast, programmable, and borderless.

For individuals, they make digital finance feel practical.

For institutions, they offer real-time settlement and global reach.

And for regulators, they pose the question: Who controls the next era of money — banks, governments, or code?

The revolution isn’t loud or flashy.

It’s happening in the background — one stablecoin transaction at a time.

💬 What’s Next

Up next on Byte & Block:

- “The Intersection of AI and Blockchain — Where Data Meets Decentralization”

- “How Smart Contracts Are Eating the Internet”

Follow @byte_and_block for bite-sized insights, or subscribe to the newsletter for deeper dives.

Subscribe to our newsletter!